Are you a savvy real estate investor looking to defer capital gains taxes and reinvest in potentially more lucrative properties? If so, a 1031 exchange might be the key to unlocking greater returns on your investments. In this article, we’ll provide you with a comprehensive guide to understanding 1031 exchanges and how you can leverage this powerful tax-deferral strategy to optimize your real estate portfolio.

What is a 1031 Exchange? A 1031 exchange, also known as a like-kind exchange, is a tax-deferred transaction that allows real estate investors to sell a property and reinvest the proceeds into a new property of equal or greater value. The name “1031” refers to Section 1031 of the Internal Revenue Code, which outlines the rules and requirements for these exchanges.

Key Benefits of 1031 Exchanges:

- Tax Deferral: One of the primary advantages of a 1031 exchange is the ability to defer capital gains taxes. By reinvesting the proceeds into another qualifying property, investors can postpone paying taxes on their gains, allowing them to leverage more capital for future investments.

- Portfolio Diversification: Investors can strategically diversify their real estate portfolio by exchanging properties in different locations or asset classes. This flexibility allows for a more robust and risk-balanced investment strategy.

- Increased Cash Flow: Swapping an underperforming property for one with greater income potential can lead to increased cash flow, enhancing the financial viability of your real estate investments.

- Wealth Accumulation: As you continue to defer taxes through successive 1031 exchanges, your wealth can accumulate faster, providing you with more financial resources for future investment opportunities.

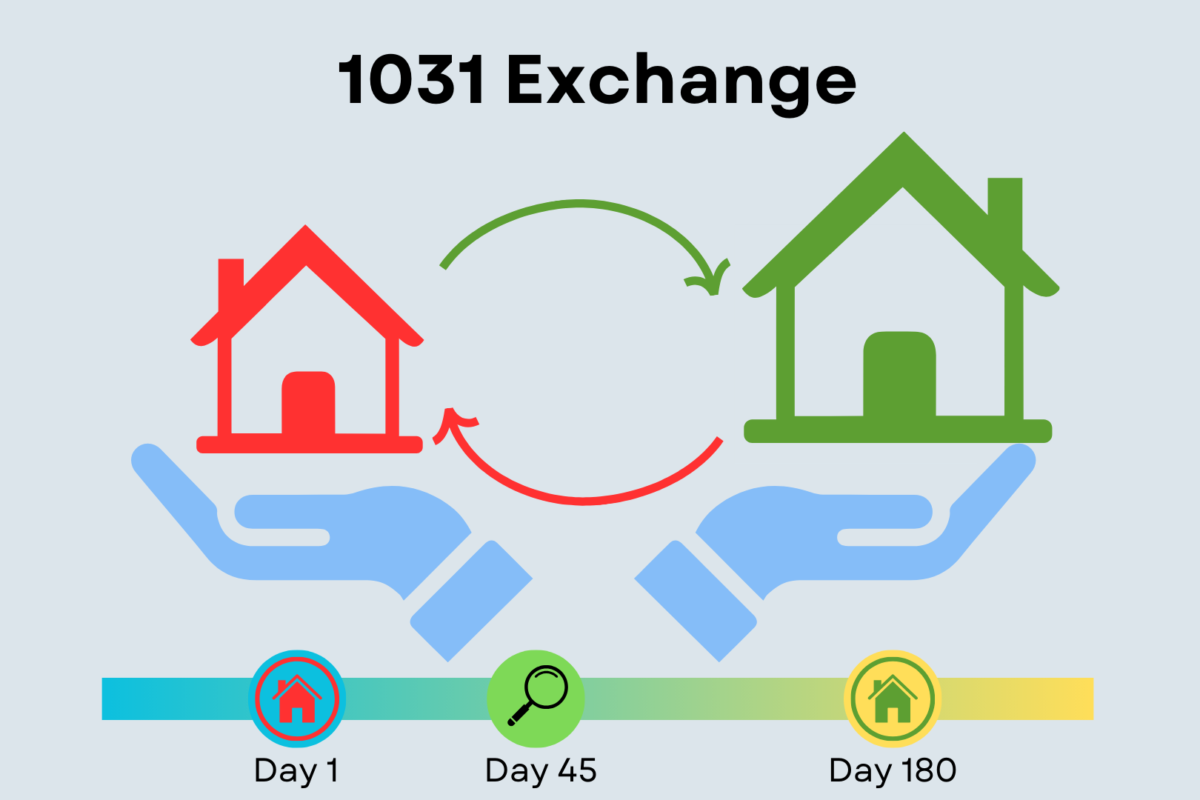

Navigating the 1031 Exchange Process: While the benefits of a 1031 exchange are clear, it’s crucial to understand the process and adhere to IRS guidelines. Here are the key steps involved:

- Identify Replacement Property: Within 45 days of selling the relinquished property, identify potential replacement properties. You can identify up to three properties, regardless of their value, or any number of properties as long as their total value does not exceed 200% of the relinquished property’s value.

- Close on Replacement Property: Complete the acquisition of the replacement property within 180 days of selling the relinquished property. This timeline is critical, and failure to meet it may result in the disqualification of the exchange.

- Work with a Realtor Experienced in 1031 Exchanges: Engage the services of a realtor with experience in 1031 exchanges. An experienced realtor can provide valuable insights, help you identify suitable replacement properties, and navigate the complexities of the exchange process.

- Work with Qualified Intermediaries: To ensure compliance with IRS regulations, work with a qualified intermediary who will facilitate the exchange process and hold the proceeds from the sale of the relinquished property until the replacement property is acquired.

Ready to take advantage of the benefits offered by 1031 exchanges? Consult with a qualified intermediary, financial advisor, and a realtor experienced in 1031 exchanges to assess your specific situation and develop a strategic plan for maximizing the returns on your real estate investments. Don’t miss out on the opportunity to defer taxes, diversify your portfolio, and build lasting wealth through intelligent 1031 exchanges.

Remember, the key to a successful exchange is proper planning and execution. Start exploring the possibilities today and unlock the full potential of your real estate investments with 1031 exchanges.

Leave a Reply